If this is the case, your refund may be offset (applied to pay that debt). Refund used to pay other debts: Sometimes you or your spouse may owe a tax debt to the IRS or a debt to other agencies, including child support or student loans. Follow these steps if you know you made a mistake, before the IRS contacts you.For more detailed information, the Acting National Taxpayer Advocate wrote about this issue in a Most Serious Problem in the 2019 Annual Report to Congress. If the IRS is attempting to reconcile income and withholding amounts, be aware that TAS has implemented new case acceptance procedures for non-identity theft refund fraud cases during filing season 2020.This process is generally the cause for delayed refunds.If the IRS is reviewing your return, the review process could take anywhere from 45 to 180 days, depending on the number and types of issues the IRS is reviewing. See our Held or Stopped Refund page or our video for more information.If this is the case, the IRS will send correspondence either asking for more information or letting you know your tax return was adjusted and why. See our Tax tip for keeping safe on social media at tax time too.Įrrors on or Incomplete Tax Returns: Your refund may be delayed for something as simple as a forgotten signature or because there is some other type of error, including mathematical errors or if the income reported by you doesn’t match what your employer or other third-party payers have reported. You can also see our Identity Theft page or for more information.The right ones for you are based on what’s happening with your tax account, so follow the instructions in the correspondence.

#My refund status verification#

If you receive an IRS letter or notice about your claim, reply immediately following the steps outlined and using the contact information provided. However, if there are problems with any of the information related to the claim, your refund will be held, and you will be asked to supply more information. Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC): If you claimed the EITC or the ACTC, and there are no errors, you should receive your refund, if you selected Direct Deposit around the first week of March. Support strong local journalism by subscribing at /subscribe. Silas Sloan is the growth and development reporter. Essentially, you're not getting a state refund because you didn't pay any state income tax.Īn earlier version of this article mistakenly cited an outdated Tennessee interest income tax rate that no longer applies. Tennessee has no state income tax, so Tennesseans are not required to file a state return. OK, that sounds ominous, but there's a reason. Processing tax returns that need to be corrected.The IRS is still dealing with service delays as a result of the COVID-19 pandemic.

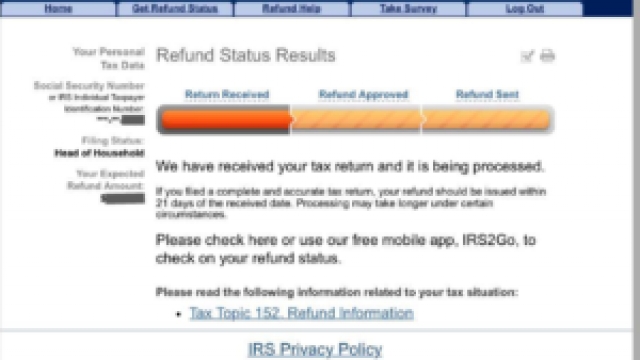

Should your return be delayed for extra review or corrections, the IRS will alert you via email. If you filed a paper return, you will need to wait at least four weeks after submitting before checking the status of your return. The tracker will say where your refund is in the process. Your Social Security or taxpayer ID number.To track your federal return, the IRS has a handy tool at irs.gov/refunds to check your refund's status.Ĭlick the "check your refund" button.

0 kommentar(er)

0 kommentar(er)